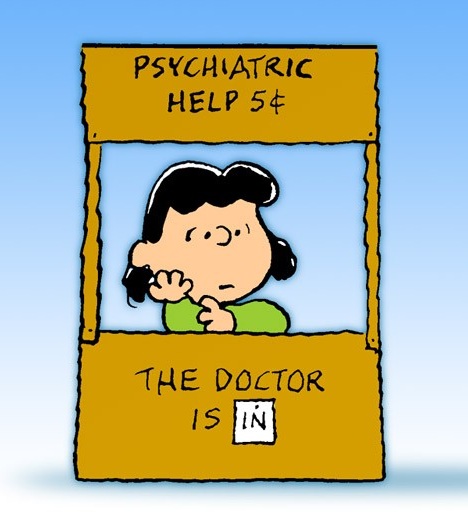

Beware of ‘helpful advice’ that isn’t

We’ve all had that friend who volunteers to help with a chore or a task and whose “help” only makes the situation worse.

It’s the buddy who says he’ll help you move, but whose back problem mostly limits him to complaining. By the time you figure out the cost of accepting his help, it’s too late to ease your burden.

I worry a lot these days that consumers and investors have a lot of “those friends” when it comes to how and where they get their financial advice.

That’s because, according to a new survey out from Marcus by Goldman Sachs, one-fourth of millennials are getting their investment advice from podcasts and social media.

That shouldn’t be a surprise — and not just because Edison Research says that some 80 million Americans now listen to podcasts weekly – because the same Marcus survey found that huge chunks of Americans find investing, saving, and managing debt to be “overwhelming,” mostly because they feel uninformed and struggle with their decision-making.

But if you’re having troubles matching your personal level of expertise to your financial chores, you may also have a problem deciding whose advice to follow.

This column in the last few weeks has tried to sort out trust issues when it comes to the information you read (http://column.moneylifeshow.com/2021/09/15/learn-who-your-source-is-before-trusting-their-money-ideas) and the advisers you hire (http://column.moneylifeshow.com/2021/09/22/you-need-a-process-not-luck-to-find-the-right-financial-adviser/).

But deciding if you can trust a favorite blogger, podcaster, celebrity financial adviser or journalist turned radio host – and, yes, that means me – is muddied by the modern world and the changing technologies we accept into our lives.

Not so long ago, when mainstream media was the dominant information source and people got personal-finance news from the local paper, business-talk radio show or a trusted television source, there was separation between advertising and information, and the ads were clearly delineated.

In decades as a newspaper and online financial columnist for what are now considered old-media organizations, I never once was offered money in exchange for a mention in my column. I wasn’t even offered the mutual back scratch, the promise of a plug in their work if I mentioned them in mine.

My employers sold ads and paid my salary without influencing my work; I covered anything I felt the audience should know, without regard to offending/supporting advertisers.

I still do that today. Financial journalists (I’m a past president of the Society for the Advancement of Business Editing and Writing) remain consumed with ethics and ideals; I can’t shut that off.

Those standards are not the norm as blogs and podcasts become vital sources of financial information, with attendant personalities – including many now-established money celebrities – who are mostly concerned with how to grow the audience and line their own pockets.

If you’re looking to overcome debt issues, retire by age 40 or 50, invest in cryptocurrencies, become a trader, find the next great dividend-paying stock or just about anything financial, there is someone on the Internet telling you to follow their model/example to do it.

There’s no denying that there’s plenty of great content out there, stuff that is inspiring, entertaining, funny and highly informative.

But there is a dark side amid those success stories that is seldom discussed, the back-room cross-promotional deals, the back scratching and influence peddling that’s often a steppingstone to financial success in the new media.

I do a one-hour weekday podcast talking about all things financial with some of the brightest minds in the money world, but I’m constantly approached about “swapping appearances” with newbies and virtual unknowns – someone looking to be on my show and offering an appearance on their – and about “affiliate marketing” deals, where I could earn payments for steering people to try a product, subscribe to a newsletter or simply to follow certain links.

There’s nothing inherently wrong with affiliate marketing; know what to look for and you’ll find it on podcasts run by National Public Radio and virtually every major news organization. Many affiliate deals are benign, simple links in traditional advertising.

Likewise, I appear on podcasts hosted by others – and have had some of those people on mine – although to me it’s about the quality of the guest (and their program), rather than doing things for the sake of exposure.

But I also understand what drives that push for appearing in new and different circles, because each appearance seems to bring me people hoping to hire me as a financial adviser (which I don’t do), or joining my show’s audience hoping to learn more.

And affiliate deals can cross a line too; there have been cases of podcast hosts steering audiences to everything from bad, unnecessary services to Ponzi schemes. Even when it’s clear that an endorsement is bought and paid for, consumers must be exceptionally careful.

It’s one thing if your favorite podcast host makes a buck steering you to a site they believe in — where they think you can get real help – but another if their motivation is entirely the financial reward they get from your click-through.

Forget “fake news” for a moment and think “fake endorsements” made to look so real that experts often can’t tell the difference.

I recognize that this may seem like the pot talking about the color of the kettle.

I’m in the money-talk business to make money. While I live by traditional journalistic standards, my show – Money Life with Chuck Jaffe — can’t succeed without sponsors. We’re picky about the few we work with; we do no affiliate marketing deals. I’ve found that marketers who offer the biggest affiliate payouts are trying to convince bloggers and podcasters to hawk junk that’s bad for consumers. My ethics and morals aren’t for sale.

But the more Americans rely on emerging sources of financial information, the more those sites, shows and individuals will be pressured to blur and cross the lines.

If you’re relying on financial information you’ve heard or read somewhere, consider the source. Trust but verify, because it won’t be the person who gives bad advice who suffers the financial consequences, it will be you.

#-#-#

Chuck Jaffe is a nationally syndicated financial columnist and the host of “Money Life with Chuck Jaffe.” You can reach him at itschuckjaffe@gmail.com and tune in at moneylifeshow.com.

Copyright, 2021, J Features