Big recent fund gains shouldn’t alter your focus on ‘What’s next’

At some point in the not-too-distant future, the last year of stock market gains will be a footnote to history.

Rebounding from a precipitous drop as the world lurched into the pandemic in March of 2020, the stock market reversed course and gained more than 50 percent, as measured by the Standard & Poor’s 500, over the 12 months ended March 31, 2021.

The end of the first quarter this year was when the 34 percent pre/early pandemic swoon came off of one-year returns. Now, when investors look back at the last year, it’s all gain and no pain.

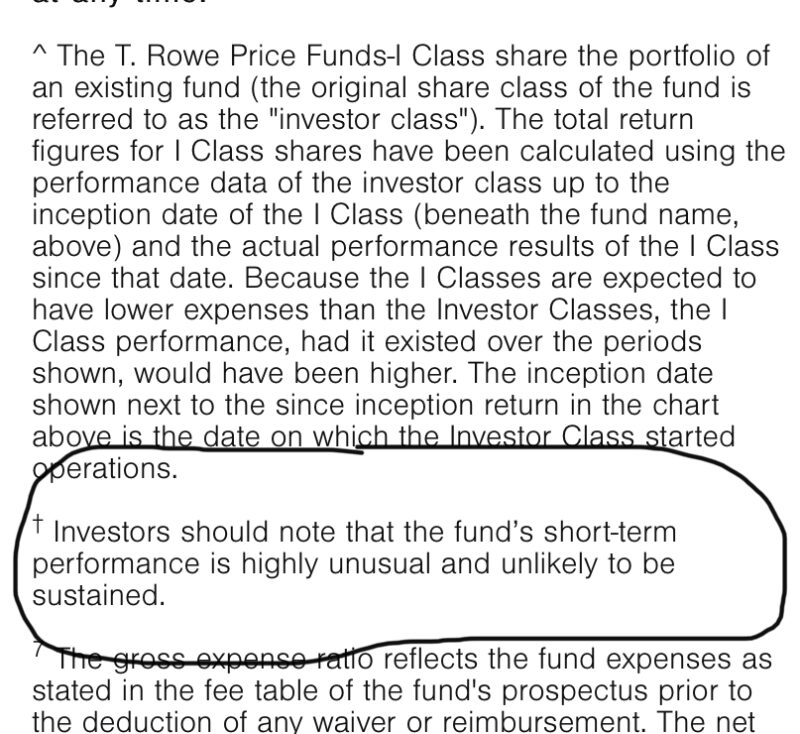

You could say that “short-term performance is highly unusual and unlikely to be sustained.”

In fact, T. Rowe Price Associates is saying exactly that, having added that footnote to its one-year results for any fund that’s up 40 percent or more over the last 12 months.

The extra footnote is as unusual as the short-term performance, but it’s underlying message is crucial right now.

For proof, consider that T. Rowe Price runs 57 stock funds across all investment categories – you can find them, and see the footnote on one-year results here: www.troweprice.com/personal-investing/tools/fund-research/stock-funds — and 51 of them had gains of more than 40 percent for the 12 months ended March 31.

Of the six funds that didn’t earn the footnote, half of them are less than a year old, two invest in real estate and one is an international fund (and all three of those funds were up at least 33 percent).

But virtually every fund company with U.S. equity funds is up big and across the board: Every single one of Vanguard Group’s U.S. stock funds posted returns above 40 percent; all but one of Fidelity’s 58 domestic equity funds that have been around for at least a year were up 40 percent or more for the 12 months ended March 31.

The problem here is what researchers call “time-period dependency,” where how a fund looks depends entirely on the time frame being measured, with results always at their best after crashes fall out of a time period.

Even longer-term results can be skewed by this problem; in time, a few years from now, it will be three- and five-year records that benefit from first-quarter 2020 being excluded.

For as often as the phenomenon is repeated, the T. Rowe Price footnote struck me as something new.

Alas, it’s a footnote, nothing to get too excited about because almost no one will actually read it, let alone take it to heart.

But it is precisely because it is so odd that investors should heed the warning and alter their expectations and thinking.

“I have never heard of a fund company adding an extra footnote like this when times are this good, but it’s a service if only as a reality check for investors,” says Jack Brennan, the former Vanguard chief executive whose new book “More Straight Talk On Investing: Lessons for a Lifetime” is due out April 27. “Right now, fund companies should be tempering the euphoria; you won’t go wrong by doing that.”

While the current conditions are showing strong upward momentum and volatility across the board, T. Rowe Price officials didn’t make a big decision to add the note to performance charts. Indeed, this is something the firm has done in the past.

“We picked a threshold of 40 percent, so for any fund whose performance was greater than 40 percent over a one-year period, we thought this additional education for individual retail investors was really important so that they are making informed decisions and not chasing performance,” said Phil Korenman, head of individual investors at T. Rowe Price in an interview on my podcast “Money Life with Chuck Jaffe.”

Korenman noted that the firm regularly reviews performance for “out-sized returns” and adds the warning to charts as needed. It was necessary back in the technology bubble days of the 1990s, and has come up occasionally over the years on specific hot, focused strategies, but it has never been as broadly in play as it is now.

It’s a warning for investors “to be really cautious, and make sure they are making an informed decision and not just getting caught up in market timing and chasing returns,” he added.

In contacting other fund companies asking why they don’t take a similar step, one common point was that they weren’t sure a warning would be equally appropriate if funds were down big.

They’re missing the point.

No one dives into a fund when the market is tanking broadly, let alone jumps into something with the biggest losses, but put up wins of 55 percent – let alone the 90 or 100 percent increases plenty of funds have seen – and the money floods in.

The key words in the footnote – in full, it reads “Investors should note that the fund’s short-term performance is highly unusual and unlikely to be sustained” – are the ones telling you, the investor, to take notice.

Short-term returns tell you more about the market than about any individual fund; they’re just about the last thing investors should use to select a fund or to evaluate the performance of one they own.

They’re a siren song, misleading even in conventional times when they exhibit normal divergence.

Pick and evaluate a mutual fund for what it does for your portfolio and how it fulfills the job you got it for. Buy a fund because of the assets and strategy it brings to your holdings, because it diversifies your portfolio, for its investment objective, cost structure, its ability to inspire your confidence and more.

Long-term past performance can be part of that formula, but short-run numbers should be nothing more than a footnote to your decision-making. In fact, they can be ignored, the way most footnotes are.

That will make it easier to remember that, when it comes to your mutual funds, “What have you done for me lately?” is much less important than “What can you do for me next?”

#-#-#

Chuck Jaffe is a nationally syndicated financial columnist and the host of “Money Life with Chuck Jaffe.” You can reach him at itschuckjaffe@gmail.com and tune in at moneylifeshow.com.

Copyright, 2021, J Features